Chart of the Week: “All that glitters is not gold”

September 25, 2018

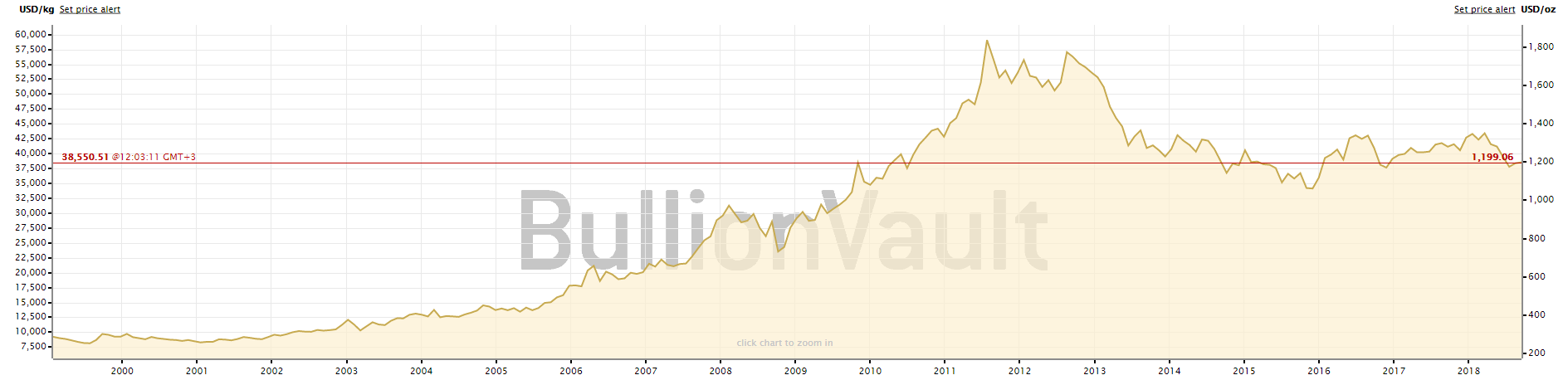

Gold is one of the most misunderstood financial instruments in the world. Seniors who lived through a period of hyperinflation see it as a hedge against inflation. That is incorrect, as the price of gold has not kept up with inflation. Others see it as a store of value, but the very high volatility puts that thesis to shame – a store of value should not have such extreme price moves (it has one of the highest volatility levels among commodities). Others see it as the only “true” currency, as it theoretically cannot be printed into oblivion as paper money can. However, that is also incorrect, as financial instruments (futures, swaps, options, etc.) can mean that “paper gold” can massively exceed physical gold (countries such as Germany have asked for delivery of physical gold that has been lent out).

Also, currencies generally do not have such violent moves as does gold. Traders see gold as just another financial instrument, along with equities, REITs and bonds, each one competing for investor attention at different times. And lastly, the non-believers see gold as just a shiny rock, with no more value than the small commercial interest it generates (jewelry, filings, etc.). So who is right? At the end of the day, any financial instrument is only worth what someone will pay for it. But the high volatility of gold means that no portfolio should really exceed a 10% allocation to gold.